option greeks pdf

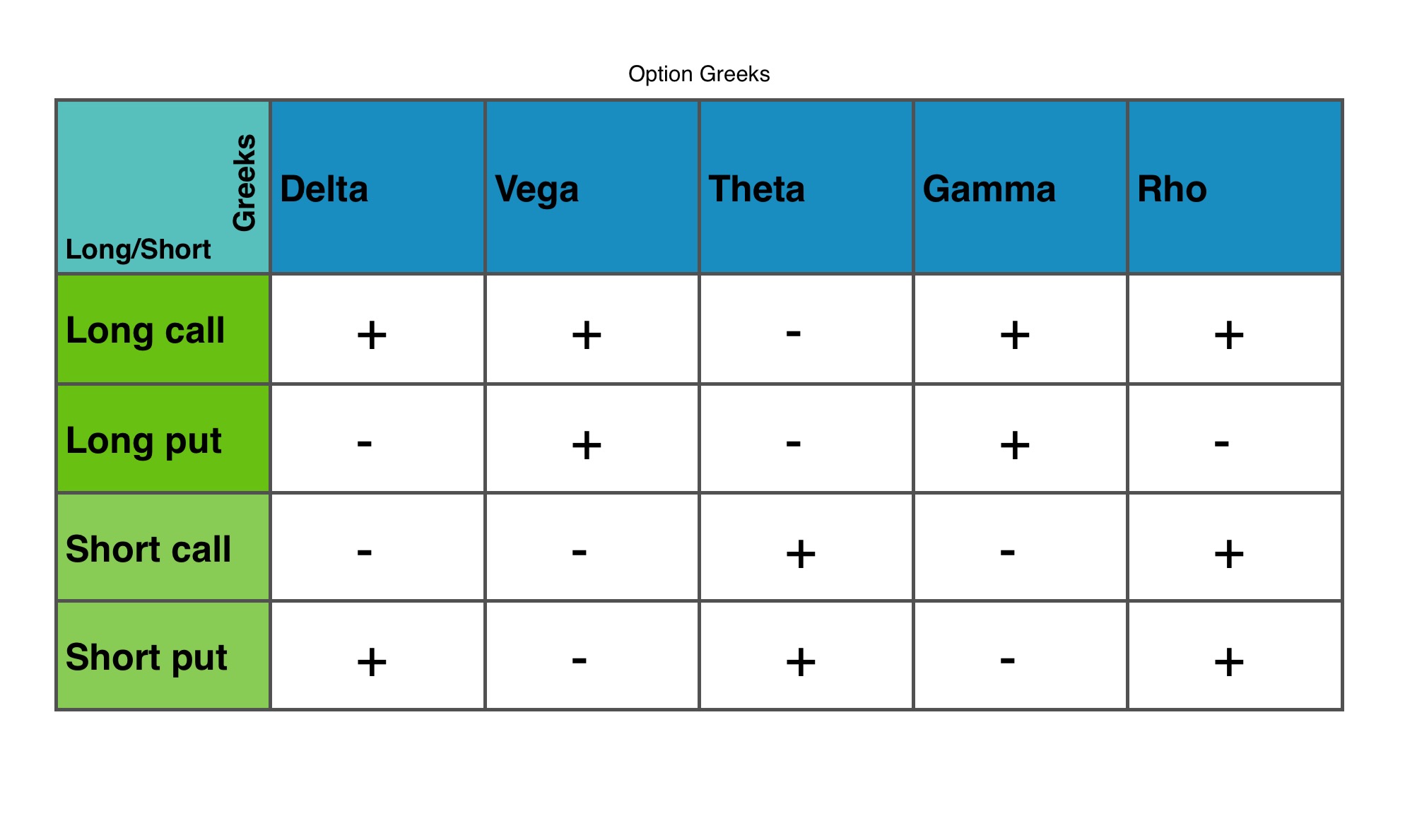

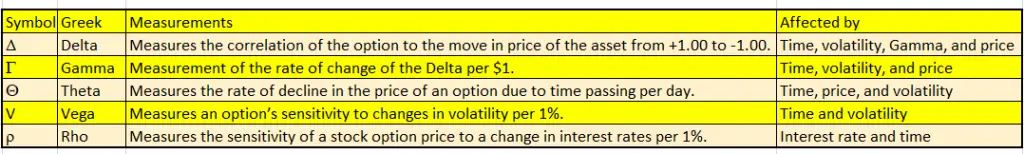

The price of underlying Gamma 2 nd derivative of price Vega volatility Theta time Rho. For the sake of simplicity the examples that follow do not take into consideration commissions and other transaction fees tax considerations or margin.

Pdf Trading Option Greeks Download Book Online

Free book shows how to generate 20196 per day trading options a couple times a week.

. Ad Rich options pricing data and highest quality analytics for institutional use. Download or Read Online Trading Options Greeks in PDF Epub and Kindle. Normpdfselfd1 selfT 05 3 VEGA 11.

GAMMA The options vega is a measure of the impact of changes in the underlying. The Greeks are utilized in the analysis of an options portfolio and in sensitivity analysis of an option or portfolio of options. Ad Free strategy guide reveals how to start trading options on a shoestring budget.

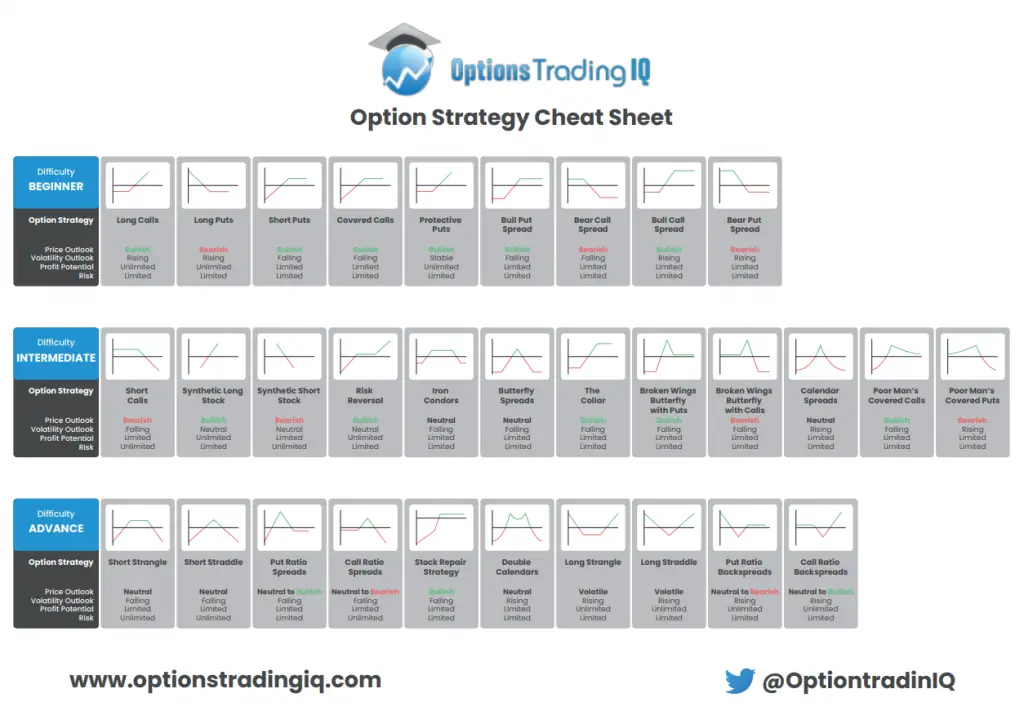

Greeks can help you plan your trades to take advantage of. Option pricing models value options taking as given information about these factors at a point in time. Take Your Options Trading to the Next Level with Innovative Tools Educational Resources.

Dan Passarelli - Trading Option Greekspdf - Free ebook download as PDF File pdf Text File txt or read book online for free. A top options trader details a practical approach for pricing and trading options in any market condition The options. Here is an Option Greeks cheat sheet you can use as a quick reference guide.

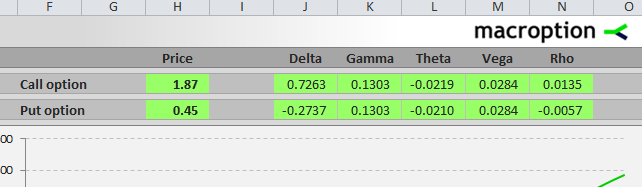

Option sensitivities formula proofs and Python scripts Part A - 1st order greeks The Smile of Thales April 11 2015. Analytic and Tick Data. The delta of each option is.

Check Pages 1-50 of DAN PASSARELLI - TRADING OPTION GREEKS in the flip PDF version. Ey are the key. The measures are considered essential by many.

8 Delta of a Portfolio Example Suppose a financial institution in the United States has the following three positions in options on the Australian dollar. Greeks are dynamic and constantly changing. Download View Dan Passarelli - Trading Option Greekspdf as PDF for free.

How Time Volatility and Other Pricing Factors Drive Profits is an amazing advertising book. The Greeks can help you examine your exposure to various options centric risks. At-the-money options usually have a Delta near 050.

Or out of the money. Trading Option Greeks written by Dan Passarelli and has been published by John Wiley and Sons this book supported file pdf txt epub kindle and other format this book has been release on. Strategy on the basis of mathematical formulations the u2.

First order greeks in. Introduction Options are instruments whose values are affected by many factors. The five Greeks that this study will focus on are D elta first derivative of.

Besides explaining the mathematics behind volatility trading and the various features of this trading d 20t d10t σ T t. The Delta will decrease and approach. Deep Historical Options Data with complete OPRA Coverage.

In a sense the title of the Trading Options Greeks. Put options have a negative Delta that can range from 000 to 100. THE BASICS OF OPTION GREEKS CHAPTER 1 The Basics 3 Contractual Rights and Obligations 3 ETFs Indexes and HOLDRs 9 Strategies and At-Expiration Diagrams 10.

Scribd is the worlds largest social reading and publishing. Trading Options Greeks. DAN PASSARELLI - TRADING OPTION GREEKS was published by MyDocSHELVES.

Suppose you have a portfolio of options Assume it has options one one stock S and that volatility for all the options is σ dΠ Π y δs Π s δt 1 2 2Π s2 δs2 1 2 2Π t2 δt2 2Π st. For those not familiar with option pricing it can also be an educational guide as well. See the options trade you can make today with just 270.

Ad Options Trading For Newbies is written for beginners with small accounts. Options are to the particular risk source one should look at the Greeks options Hull 2002 - quanti-ties denoted by Greek letters representing options sensitivities to risk. Take Your Options Trading to the Next Level with Innovative Tools Educational Resources.

Options that are very deeply into or out of the money have Γ gamma values close to 0.

Ebook P D F Trading Options Greeks How Time Volatility And Other Pricing Factors Drive Profits Pre Order

Dan Passarelli Trading Option Greeks Pdf

Option Pricing Models And Volatility Using Excel Vba Wiley

Options Pricing Option Greeks Explained Trade Options With Me

Dan Passarelli Trading Option Greeks Pages 1 50 Flip Pdf Download Fliphtml5

Option Greeks Cheat Sheet New Trader U

Option Greeks February 8 2016 By Thomas Mann All Things Stocks Medium

Option Greeks Excel Formulas Macroption

Option Strategies Cheat Sheet New Trader U

Dan Passarelli Trading Option Greeks Pages 1 50 Flip Pdf Download Fliphtml5

Trading Option Greeks How Time Volatility And Other Pricing Factors Drive Profit Wiley

Pdf Trading Options Greeks By Dan Passarelli Ebook Perlego

Pdf On Volatility Trading Option Greeks Publishing India Group Academia Edu

Trading Option Greeks By Dan Passarelli Pdf Download Read

Download Pdf Trading Options Greeks How Time Volatility And Other Pricing Factors Drive Profits By Dan Passarelli Online New Chapters Twitter

Read Pdf Trading Options Greeks How Time Volatility And Other Pricing Factors Drive Profits Bloomberg Financial Book 159 R A R

Option Greeks February 8 2016 By Thomas Mann All Things Stocks Medium

Trading News Option Trading Stock Options Trading Stock Trading Strategies

Pdf Hedging Option Greeks Risk Management Tool For Portfolio Of Futures And Option

Comments

Post a Comment